Welcome to Clever Engineers

App & Web Development Services, Web Scripts & Website Maintenance

We build production-ready web and mobile solutions for startups and businesses — including custom web scripts, admin dashboards, e-commerce systems, and reliable website maintenance support. Clean architecture, secure code, and clear documentation, delivered with precision.

About us

About us

Reliable software development built to scale

Clever Engineers is a software development studio specialising in app and web development, custom web scripts, and ongoing website maintenance services. We focus on modular systems, reusable components, and maintainable code so your platform stays stable, secure, and scalable for years.

- App & web development for startups, agencies, and growing businesses.

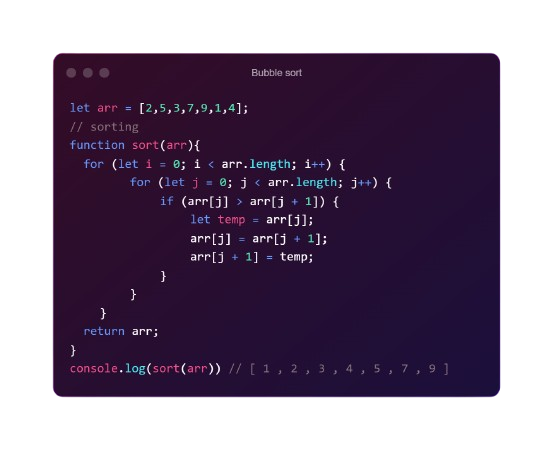

- Custom web scripts, dashboards, portals, and automation tools.

- Website maintenance, performance optimisation, security updates, and support.

Our software services

We deliver app and web development services, custom web scripts, and long-term website maintenance support — from business websites and web apps to dashboards, portals, and complete e-commerce engines.

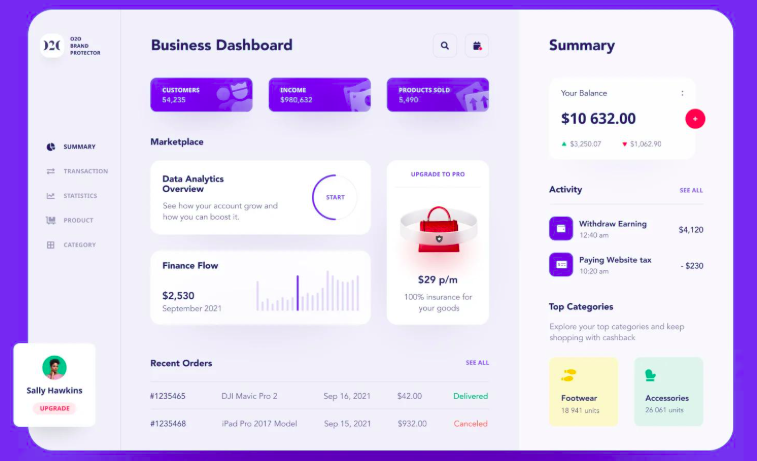

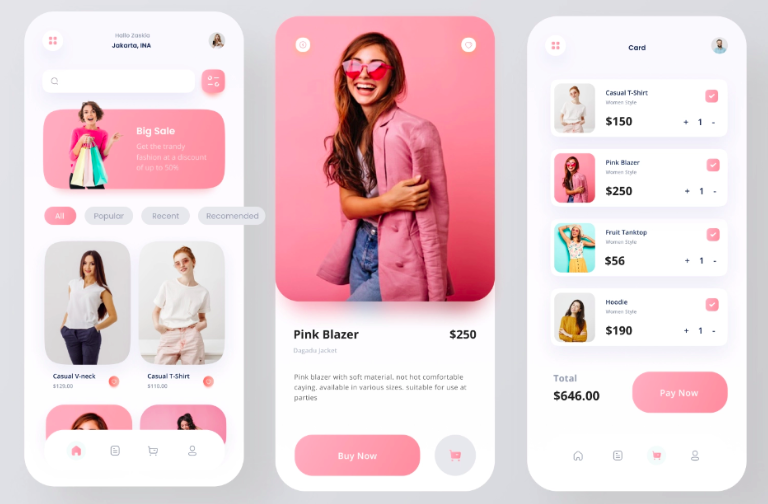

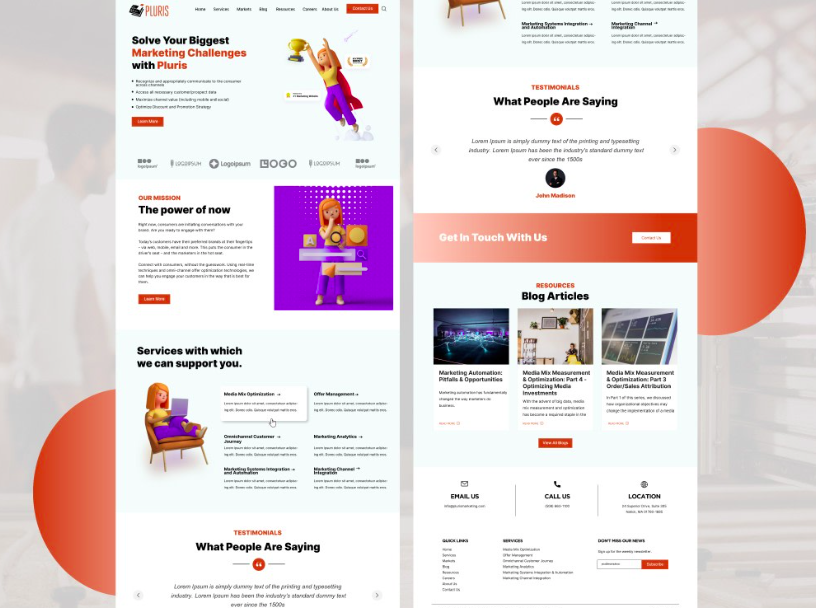

App & Web Development

End-to-end web and mobile development for startups and businesses — fast, secure, and scalable platforms built with clean architecture and modern UI.

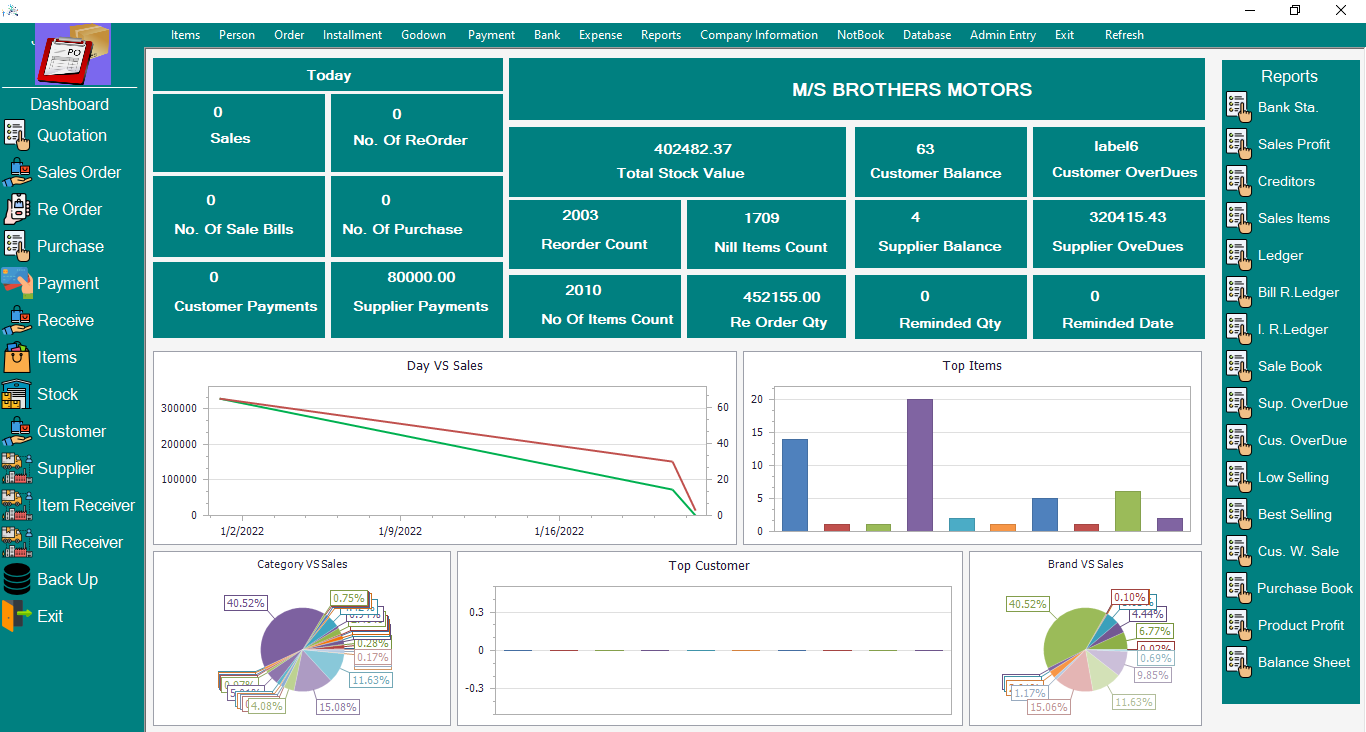

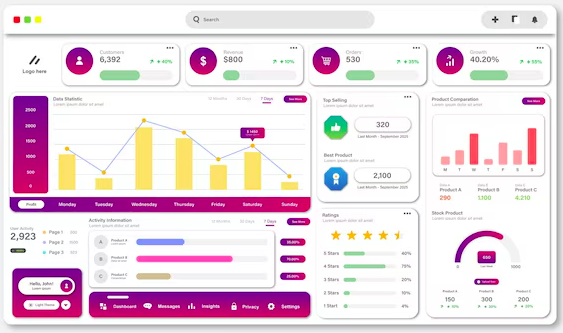

Web Scripts, Dashboards & CRMs

Custom web scripts, admin dashboards, CRMs, portals, and automation systems to streamline operations, track performance, and manage users efficiently.

Website Maintenance & Freelance Support

Reliable website maintenance services and freelance development support — security updates, bug fixes, performance optimisation, backups, and on-call help.

Ready-to-use web scripts & templates

Explore production-ready PHP MVC scripts you can deploy as-is or customise for clients — ideal for agencies, freelancers, and founders who want to ship faster.

Leo - AI Image & AI Video Generator

Mozzu - AI Based Online Food Ordering System & Multi-Restaurant with SaaS

Atlas Laravel Business Directory Listing

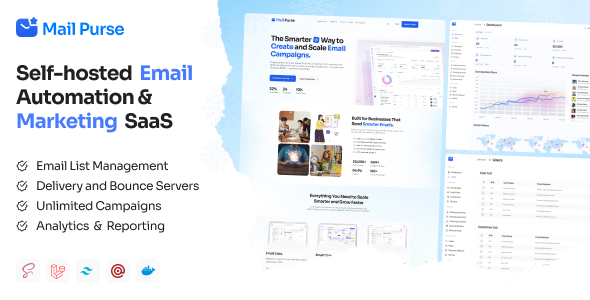

MailPurse - Self-hosted Email Automation & Marketing SaaS

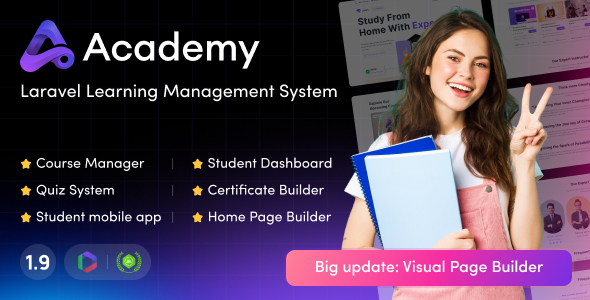

Academy LMS Laravel Learning Management System

MagicAI - OpenAI Content, Text, Image, Video, Chat, Voice, and Code Generator as SaaS

Perfex - Powerful Open Source CRM

SalesERP – AI Powered Business ERP for Sales, Billing, Inventory, Accounting And HR

App & Web Development, Web Scripts and Website Maintenance Services

Clever Engineers is a professional software development studio offering reliable app and web development services for startups, agencies, and growing businesses. We design and build secure, scalable, and maintainable digital products that are ready for real-world use.

Our expertise includes custom web application development, backend systems, admin dashboards, and web scripts tailored to business workflows. Whether you need a complete web platform, automation tools, or internal dashboards, we focus on clean architecture, performance, and long-term stability.

We also provide ongoing website maintenance services to ensure your website remains secure, fast, and up-to-date. Our maintenance support covers bug fixes, performance optimisation, security updates, backups, and feature enhancements, allowing businesses to focus on growth while we handle the technical side.

For businesses and founders looking for flexible support, we offer freelance web development services. From short-term development tasks to long-term technical partnerships, our freelance services are transparent, reliable, and production-focused.

At Clever Engineers, we believe software should be built to last. Every project is developed with scalability, documentation, and maintainability in mind — making us a trusted partner for app development, web development, custom web scripts, and website maintenance services.